The advice I give to all entrepreneurs is “that in all things in life, choose your partners wisely”. But what does that mean? It really applies at all levels.

TEAM - When you are putting your startup team together, choose your partners wisely. Your business idea may take off as a viable startup. You will find that you will be spending a lot of time together, often more time with your teammates than with your boyfriend, girlfriend or even spouse. The key factors in selecting the right teammates are:

- What skills do they bring to the party? Do their skills add value to the team? Do their skills compliment your skills or do they just duplicate your skills? Ideally, new team members skills will add strength to the team and not duplicate your or existing skills.

- Do their values align with mine or the teams? If your team is not on the same page in terms of core values and objectives, you will have built in conflict for as long as you work together. This does not mean you all think alike, in fact diversity of opinion, and diversity in general adds strength to any team. But don’t confuse differences of opinion from differences in core values.

When teams go to investors for funding, one of the things investors look for is a balance of critical skills on your team which are needed to execute the business strategy.

(Need help building your team? Use our Team Finder tool and post a request!)

ADVISORS – Many startups select an advisory board to help with strategy and to open doors. When you are putting an advisory board together, choose your partners wisely. Just as you should strive for a balance of critical skills on your core team, you should strive for the same balance in your advisory board. Advisory boards are not the same as your board of directors. Advisory boards help early-stage companies get to the next level where they can begin to raise capital. Once you start taking on investors and raising capital is when you develop a board of directors who are investors. Investors like to see experts with “grey hair and scar tissue” advising the team.

An ideal advisory board has these key elements:

- A domain expert – Let’s say you are a medical device start-up related to heart surgery. Listing the head of cardiatric surgery for UPMC as an advisor gives you instant credibility.

- A business development expert – Having someone on your advisory board who has taken a business from an idea to full commercialization is invaluable, for they know where all the pitfalls are of growing a business. Ideally, find someone who has done this in the same space as your business.

- A technical expert – If you have a medical device, having someone on your advisory board who has technical manufacturing experience could be invaluable.

- A marketing wizard – Conceiving and designing a great product or company doesn’t mean anything if no one knows about you. Having a seasoned marketing expert advisor is essential.

When looking for advisors, try to find the most experienced advisor possible to establish the most gravitas possible. Look on LinkedIn for former Chairman and CEOs of related companies that fit your needs. A great advisor will not just provide great strategic advice, they can open doors for you by making introductions to their vast business contacts.

INVESTORS – At some point many startups need to raise venture capital to grow quickly and gain a “first-mover advantage”. So, you put together a compelling story and create a pitch deck and approach angel investors and venture capitals looking for investment. Here again, “choosing your partners wisely” is critical. Many entrepreneurs are so concerned about getting funded that the tendency is to take the first money offered. This can be a big mistake. The goal should be to find the “right money”, not the “first money”. Your investors are your partners for the duration of your company (until it has an exit or implodes). So, what is the “right money”? Here are some things to consider when choosing investor partners:

- Financial capacity - Besides the money in your initial “ask”, do they have enough reserves (”dry powder”) to provide follow up funding that many startups need?

- Beyond the checkbook – What can the investors bring to the company besides their checkbook? What doors can they open for you? What strategic advice or expertise do they have? Are they familiar with your industry?

- Shared vision for the company - Perhaps the most critical point is having a shared vision for the company. If this does not exist, having an investor/partner with different ideas on direction or strategy will make your life very, very difficult.

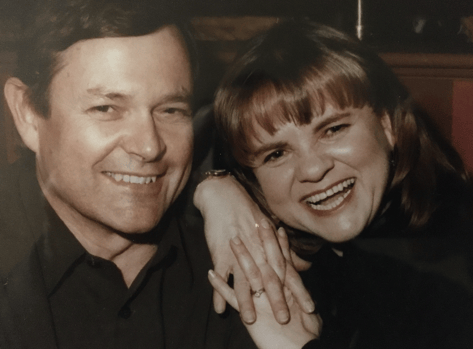

Big Idea Center EIR Don Morrison (left) with his wife, Tina (right).

Big Idea Center EIR Don Morrison (left) with his wife, Tina (right).

LIFE PARTNERS/SIGNIFICANT OTHERS - Entrepreneurship is not easy. Starting up a new business is hard and requires many long days and a lot of sacrifice. You must face challenges and rejection every day. At the end of a long day, going home to your significant other can be a positive reinforcement or a battle. Why are you late for dinner, again? How long is this going to go on? This type of daily interrogation can be draining and energy sapping. It creates additional stress, which is very unhealthy.

On the other side of choosing a life partner wisely would be questions like, “how was your day? Is there anything you need from me?” Having a supportive spouse or partner makes life less stressful and you more productive.

So, in selecting your TEAM, ADVISORS, INVESTORS and LIFE PARTNERS, choose your partners wisely!