April is National Financial Literacy Month in the United States. It marks a month where local community organizations, financial institutions, governmental organizations, and others focus on increasing the financial literacy of their constituents. In this blog article, Joel Philistin, Director of Pitt's Financial Wellness Program, shares five key principles that entrepreneurs can apply to build their financial literacy skills and knowledge.

A recent CNBC survey reports the following:

• 77% of Americans report feeling anxious about their financial future.

• 58% feel that finances control their lives.

• 52% have difficulty controlling their money-related worries.

• Key concerns were not being able to retire, keeping up with the cost of living, and managing debt levels.

Another report by MarketWatch found that nearly 70% of respondents are familiar with 401(k)s but do not use them.

The goal of financial literacy month and year-wide programming is to educate US communities to increase financial confidence and security. According to the U.S. Financial Literacy and Education Commission (U.S. FLEC), financial literacy describes the skills, knowledge, and tools that equip people to make individual financial decisions and actions to attain their goals; this may also be known as financial capability, especially when paired with access to financial products and services. The U.S. FLEC highlights five principles as the building blocks of financial literacy, known as the MyMoney Five.

The principles of the MyMoney Five provide the foundations for informed financial decision-making. Let’s review a few of the principles and how students and entrepreneurs can begin to use them.

Earning

The earn principle encourages us to make the most of our pay and benefits. Although this points to understanding paychecks, taxes, and workplace benefits, the earn principle also encourages individuals to invest in their professional future. A key element of financial literacy is taking part in professional development to increase your earning potential. For students, this means immersing yourself in your educational studies. It is also exemplified by visiting the Career Center | Division of Student Affairs (pitt.edu) to explore internships, researching the industries or products that you’re interested in, exploring designations and certificates, and networking and finding mentors. For entrepreneurs, it’s participating in the Big Idea Center and similar organizations that help you develop your business plan and learn how to pitch your business.

Spending

The spending principle encourages us to develop a budget (spending plan) and plan to use our money toward our goals and the things we truly value. In today’s society, financial decision-making and spending are impacted by tempting instant gratification. We’re constantly being marketed to and feeling pressure to keep up with lifestyles and milestones seen on social media. And with spending being as simple as a cell phone tap nowadays, it’s easy to overspend and not align our money with long-term benefits.

Regardless of your career path, it’s important to understand your spending. One best practice is to review the last 30 – 90 days of spending on your banking app. Take some time to reflect if your money is aligned with your goals, values, and expectations. For entrepreneurs, it’s important to monitor spending in your business. It is important to create business projections, keep records of revenue and spending, and be mindful of scaling at the right time. Why Financial Literacy Is Essential For New Entrepreneurs (forbes.com)

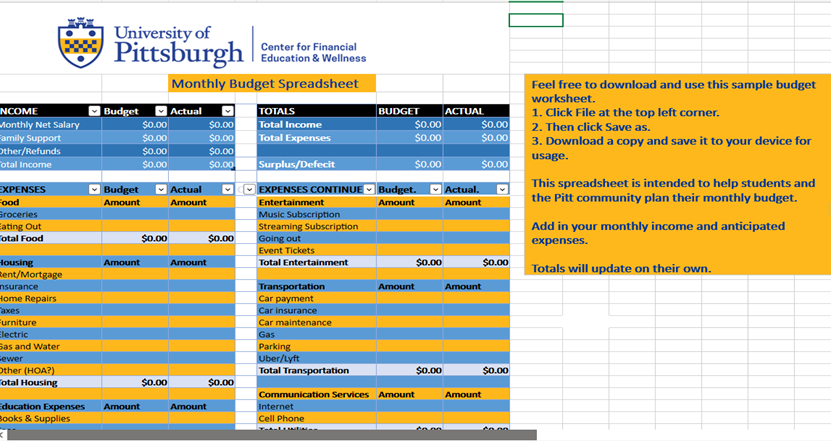

The Pitt Budget Worksheet is a free resource for students provided by the Center for Financial Education & Wellness. More resources can be found at https://financialwellness.pitt.edu/resources.

Saving and Investing

The save and invest principle encourages us to become intentional about setting money away for the future. One of my favorite financial idioms is “It’s not about how much money you make, it’s about what you keep that counts.” An intentional savings plan and investment strategy helps us to grow our wealth over time. It’s important to note that saving and investing starts with a budget. When we plan to save a percentage of our income through our budget, we intentionally plan to build wealth and create accountability for ourselves. A best practice is to save 10-20% of your income. If you are not able to save 10-20% of your income, you can begin with a lower percentage and increase over time. It’s mainly important to start the habit. For entrepreneurs, it’s important to be mindful of the profits that you earn. Having capital can help to keep your business afloat during downturns. Reinvesting profits can also be helpful as you consider growing and scaling the business. Eight Key Money Tips For First-Time Entrepreneurs (forbes.com)

Borrowing

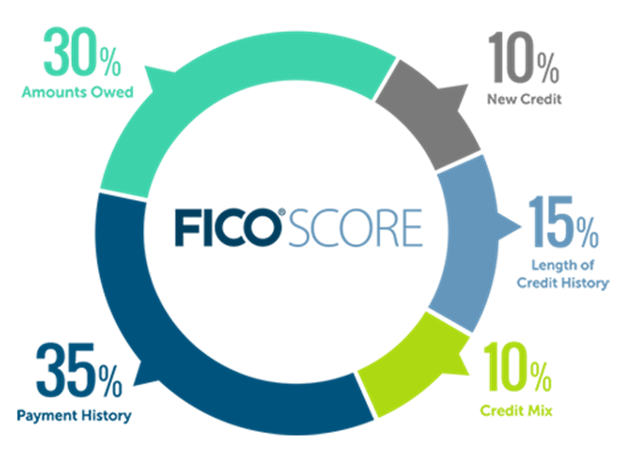

The borrow principle encourages us to understand the use of credit and when to leverage credit. Credit allows individuals to borrow money for immediate purchases and repay the debt over time, usually with interest. However, it's essential to use credit wisely to avoid financial pitfalls. The ability to receive an extension of credit will depend upon your credit report. Your credit report is used to produce a credit score. A higher credit score increases the likelihood of receiving credit and lower interest rates during repayment. It’s important to repay payments on time and limit overborrowing to increase your credit score over time. It is a best practice to create a goal to pay off debt within a defined timeline to save money on interest. Entrepreneurs may need to borrow funds to grow their businesses. Establishing business credit and understanding loan options, such as business loans, is essential for accessing capital when needed. Establish business credit | U.S. Small Business Administration (sba.gov)

Protecting

The protection principle encourages us to be prepared for potential emergencies and risks. Unexpected events can truly throw a wrench in one’s financial situation. This is why it is encouraged to have protections like an emergency savings account, being cautious about identity theft, and utilizing insurance where exposure to risks exists. A best practice in financial literacy is to build a savings account that covers 3-6 months of your monthly expenses. A key concept is to be aware of your liquidity ratio to assess how much financial cushion you have. You should also be vigilant with your personally identifiable information. This includes your social security number, passwords, driver’s license/passport, financial information, mailing address, etc. Lastly, there are some risks that a bank account or other capital cannot cover. Insurance can help to provide financial protection against potential risks like damage to property, loss, or liability caused to others. In exchange for being insured, an individual pays a monthly premium to an insurance company should a covered risk occur. A best practice is to assess potential risky outcomes or losses that could be a threat to the business and consider adding insurance coverage for protection. Get business insurance | U.S. Small Business Administration (sba.gov)

The goal of financial literacy is to improve our financial well-being. Financial well-being can be described as having a current understanding of your financial situation and adjusting to align your money with your goals and lifestyle. The Center for Financial Education and Wellness offers programming to educate students on the above topics and tools. We do not provide financial advice but can help identify skills and tools to assist in your financial journey. Feel free to engage with us via our website, or email us at finwellness@pitt.edu.

Joel Philistin is the Director of the University of Pittsburgh's Financial Wellness Program. His career objective is to help foster ideas and programs that lead to greater individual sustainability, vibrant communities, and economic opportunity. Joel has a combination of experience in the banking industry, nonprofit industry, and now higher education. In his current role, Joel helps college students understand the long term impact of college loans and demystify alarming financial behaviors. He hopes to help people create economic opportunities for themselves and their families through spreading ideas that create change.

Joel Philistin is the Director of the University of Pittsburgh's Financial Wellness Program. His career objective is to help foster ideas and programs that lead to greater individual sustainability, vibrant communities, and economic opportunity. Joel has a combination of experience in the banking industry, nonprofit industry, and now higher education. In his current role, Joel helps college students understand the long term impact of college loans and demystify alarming financial behaviors. He hopes to help people create economic opportunities for themselves and their families through spreading ideas that create change.

Sources:

Survey: 77% of Americans anxious over their financial situation (cnbc.com)

Financial Literacy Statistics (marketwatch.com)

U.S. National Strategy for Financial Literacy 2020 (treasury.gov)

How are FICO Scores Calculated? | myFICO

Understanding Liquidity Ratios: Types and Their Importance (investopedia.com)